The Greatest Guide To Clark Wealth Partners

Some Known Details About Clark Wealth Partners

Table of ContentsGetting My Clark Wealth Partners To WorkSome Known Questions About Clark Wealth Partners.The Main Principles Of Clark Wealth Partners About Clark Wealth PartnersFascination About Clark Wealth PartnersNot known Details About Clark Wealth Partners Some Known Details About Clark Wealth Partners

The world of financing is a difficult one. The FINRA Foundation's National Capacity Research, for instance, recently located that nearly two-thirds of Americans were not able to pass a fundamental, five-question monetary proficiency test that quizzed individuals on subjects such as rate of interest, financial obligation, and other reasonably fundamental principles. It's little marvel, after that, that we often see headlines lamenting the inadequate state of a lot of Americans' financial resources (civilian retirement planning).Along with handling their existing customers, monetary advisors will commonly invest a reasonable quantity of time weekly meeting with potential customers and marketing their solutions to retain and grow their company. For those taking into consideration coming to be a financial advisor, it is important to take into consideration the average salary and work security for those working in the area.

Training courses in taxes, estate preparation, investments, and threat monitoring can be valuable for trainees on this course also. Depending upon your special occupation goals, you may additionally require to gain details licenses to fulfill particular clients' requirements, such as dealing supplies, bonds, and insurance coverage. It can additionally be valuable to earn a certification such as a Licensed Financial Organizer (CFP), Chartered Financial Expert (CFA), or Personal Financial Professional (PFS).

Little Known Facts About Clark Wealth Partners.

What that looks like can be a number of things, and can differ depending on your age and phase of life. Some individuals worry that they need a specific amount of cash to invest before they can get aid from a specialist (financial advisor st. louis).

10 Simple Techniques For Clark Wealth Partners

If you haven't had any kind of experience with an economic consultant, here's what to expect: They'll start by supplying a detailed assessment of where you stand with your properties, liabilities and whether you're satisfying criteria contrasted to your peers for financial savings and retired life. They'll evaluate brief- and long-lasting goals. What's useful concerning this action is that it is customized for you.

You're young and functioning full-time, have an automobile or more and there are trainee car loans to repay. Here are some feasible ideas to aid: Develop excellent cost savings habits, settle debt, established baseline goals. Settle trainee lendings. Depending on your occupation, you may certify to have part of your school car loan forgoed.

The Basic Principles Of Clark Wealth Partners

You can go over the next finest time for follow-up. Financial consultants normally have various tiers of rates.

Always review the fine print, and make certain your financial advisor follows fiduciary requirements. You're looking ahead to your retired life and aiding your kids with college costs. A monetary advisor can use guidance for those situations and more. A lot of retirement plans use a set-it, forget-it option that allots properties based on your life stage.

Clark Wealth Partners Fundamentals Explained

Arrange regular check-ins with your planner to modify your plan as required. Stabilizing financial savings for retirement and college prices for your children can be tricky.

Assuming around when you can retire and what post-retirement years might appear like can produce concerns about whether your retired life financial savings are in line with your post-work strategies, or if you have conserved enough to leave a heritage. Assist your financial specialist understand your method to money. If you are much more conservative with conserving (and possible loss), their ideas must reply to your concerns and issues.

The Ultimate Guide To Clark Wealth Partners

Planning for wellness treatment is one of the huge unknowns in retired life, and a monetary professional can lay out alternatives and suggest whether additional insurance coverage as security may be handy. Before you start, attempt to obtain comfortable with the concept of sharing your whole monetary photo see this site with an expert.

Giving your expert a complete photo can assist them create a plan that's focused on to all parts of your economic condition, especially as you're rapid approaching your post-work years. If your financial resources are basic and you have a love for doing it yourself, you may be great on your very own.

An economic expert is not only for the super-rich; anyone encountering major life changes, nearing retired life, or feeling bewildered by economic choices might gain from expert advice. This post checks out the duty of monetary advisors, when you may require to seek advice from one, and key factors to consider for picking - https://hub.docker.com/u/clrkwlthprtnr. A monetary advisor is an experienced professional who helps clients handle their financial resources and make informed decisions that straighten with their life goals

The Ultimate Guide To Clark Wealth Partners

.jpg)

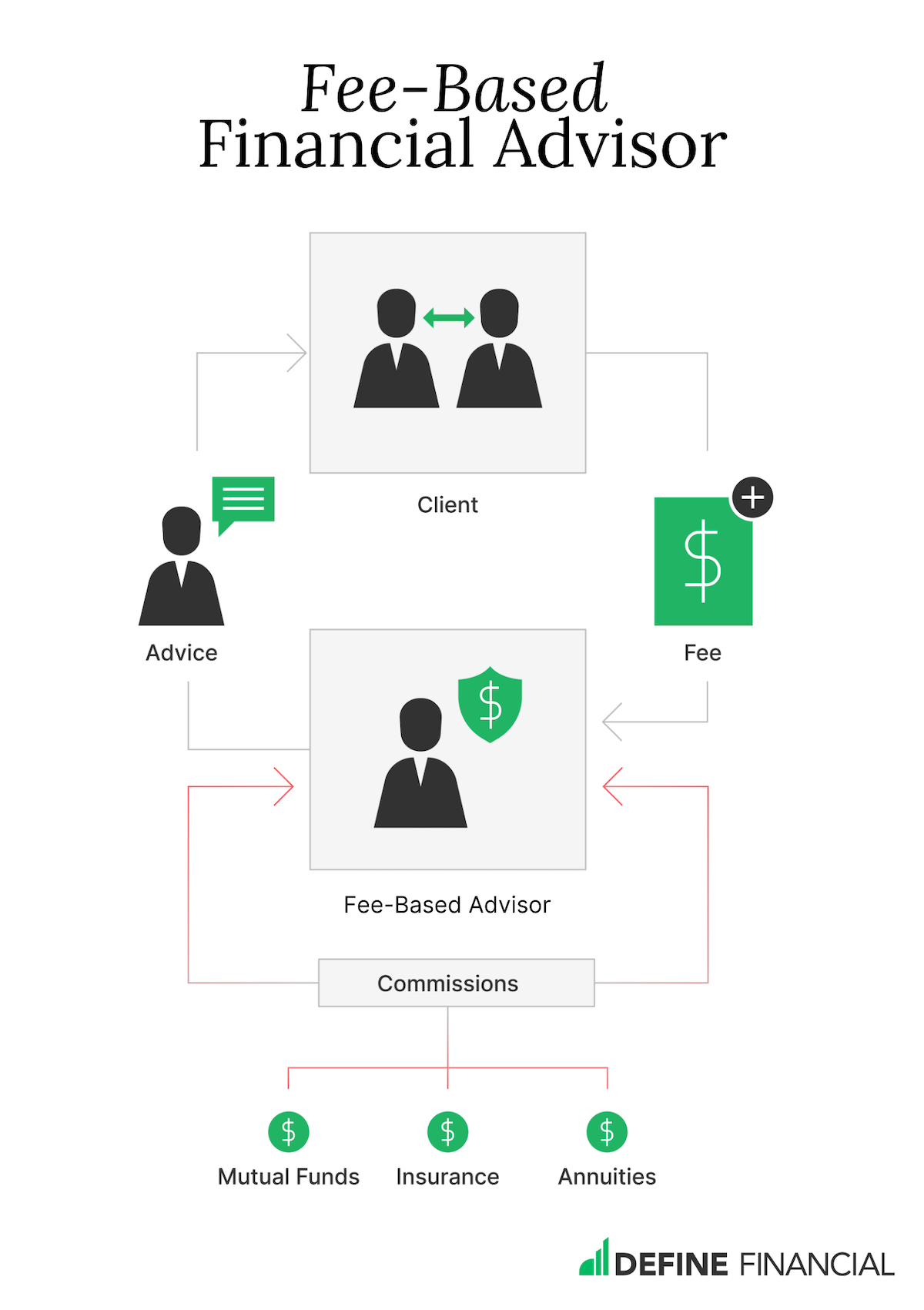

Compensation designs likewise differ. Fee-only consultants bill a level charge, hourly price, or a percentage of assets under administration, which tends to lower prospective disputes of passion. In contrast, commission-based advisors make revenue through the financial products they offer, which may affect their referrals. Whether it is marriage, separation, the birth of a kid, career modifications, or the loss of a loved one, these events have special economic ramifications, commonly requiring timely decisions that can have long lasting impacts.